Estate Tax Under President Trump

On June 15, 2017

For the first 140 years of our country estate tax only existed for short periods of time as revenue source during emergencies.1 The modern estate tax was implemented in 1916 as permanent revenue stream about three years after the federal income tax was passed into law. The estate tax was modified throughout the years, but in 2001 congress passed an act that gradually phased out the estate tax which was removed entirely in 2010. However, the estate tax was reinstated in 2011.

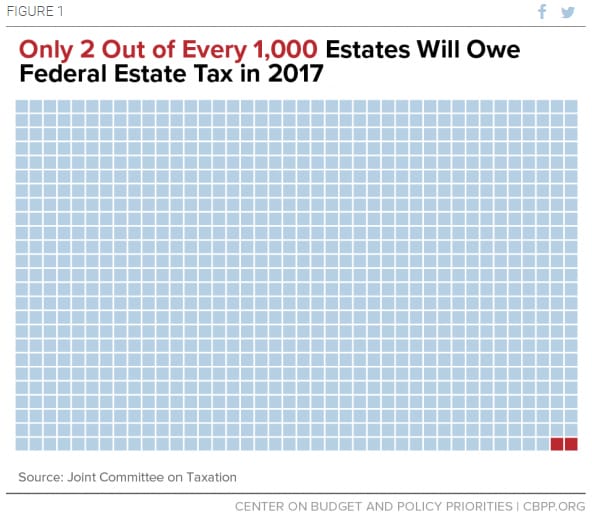

For the year 2017, the estate tax exemption is 5.49 million per person (10.98 million per married couple). Because of this high exemption only 2 out of every 1,000 estates will owe any estate tax at all.

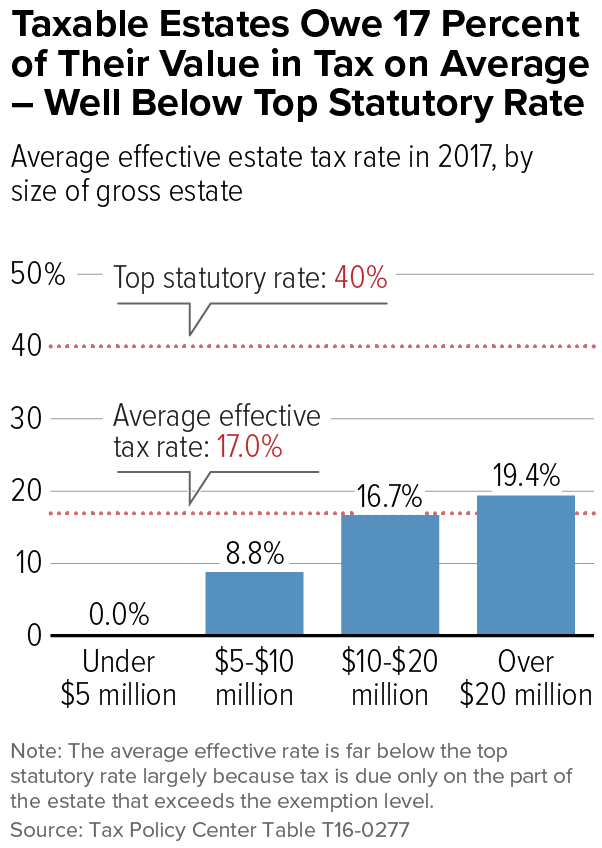

Once an estate exceeds the exemption amount the estate is only taxed on the excess of the estate. For example, for a single person with an estate worth 6 million, only $510,000 of the estate would be subject to estate tax.

President Trump has proposed eliminating the estate tax and replacing it with a capital gains tax. Currently, when a person dies, the value of the assets receive a step-up in basis for tax purposes. This means that when an asset of the deceased is sold later, the capital gains tax will be calculated only on the difference between what it sold for and what its value was at the time the deceased person died. This is normally very favorable for individuals, especially for those who do not have large estates, because it often eliminates or reduces capital gains tax when an asset is sold. Under the new proposal this step-up in basis would be reduced or eliminated, which could severely impact the beneficiaries because when they liquidate assets they receive from a deceased person, the capital gains tax could be significant.

Regardless of the size of your estate or the status of the estate tax laws, it is important to become educated and obtain sound advice from competent professionals. Whether you need an estate plan, or you already have an estate plan, we can work with you to ensure that you and your estate will be prepared for the future.

Cites

https://www.irs.gov/pub/irs-soi/ninetyestate.pdf

https://www.gpo.gov/fdsys/pkg/GPO-CONAN-1992/pdf/GPO-CONAN-1992-10-17.pdf

https://www.cbpp.org/only-2-out-of-every-1000-estates-will-owe-federal-estate-tax-in-2017